What is Car Finance and how does it work?

What is Car Finance and how does it work?

Getting a car on finance has quickly become the most popular way of buying a new car in the UK, purely due to the reason of being able to get behind a wheel without having to take a big hit out of pocket in the matter of minutes.

When you wish to apply for car finance, it is important to have all the documents ready beforehand. You will need to have:

- Proof of address

- A valid form of ID

- Proof of income (Depending on the lender)

- And a few months worth of payslips

You should always be given the option of buying the car through a finance package. There are a variety of options when it comes to financing:

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

- Personal Leasing / Contract Hire (PCH)

- Personal Loan

The best deal you can get will depend on what kind of budget you have, if you are upgrading, or if you are planning on owning the vehicle out right. It is important to understand what each financing option is about, and what you are signing up for.

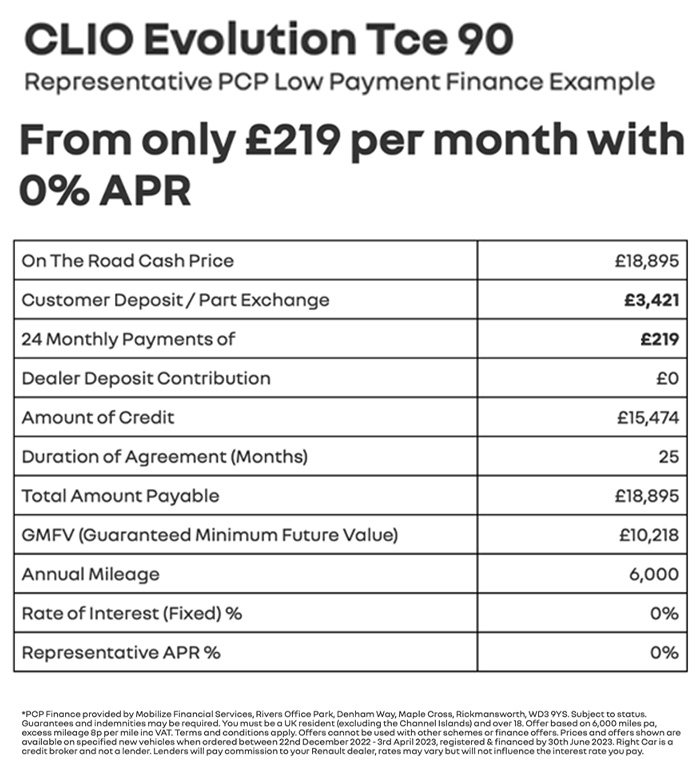

Personal Contract Purchase (PCP)

PCP could be considered a loan, but you don’t borrow the full price of the car. When it comes to a PCP deal, you will pay a deposit which can start from 10% of the car’s value but may vary, and then you will make a set of monthly payments. At the end of the agreement you will not own the car.

The cost of the monthly payments will depend on the price of the car, the interest rate (APR) and how much the value of the car is expected to drop over the duration of the agreement, which is commonly known as depreciation. Cars will lose value as soon they are driven off the forecourt, some cars will lose more value than others.

When you apply for the PCP plan, the finance company will calculate the predicted minimum value for the car at the end of the agreement. This is known as the guaranteed minimum future value (GMFV).

Once your PCP deal comes to an end, you have a few options you can take:

- Return the car at no extra cost

- Pay an optional final payment to then own the car outright

If you take the route of paying an optional final payment, it will take into account the cars GMFV that was previously agreed at the start of your contract.

So what are the pros of PCP? The manufacturer may offer a deposit contribution that would go towards the finance package. You have the ability to change your car reasonably frequently within your agreement. If you don’t want to keep the car at the end of your PCP term, you don’t have to worry about the cars depreciation. Maintenance and servicing packages are normally included.

The cons of PCP? You need to stick to the terms within the contract, if you exceed the stated mileage you agreed on fees will apply. You will not own the car unless you pay the optional final payment. If any damage, excessive wear and tear is seen on the car at the end of term, you will be charged. The optional final payment may seem unaffordable if the finances have changed since you made the PCP plan.

Hire Purchase (HP)

HP is more straightforward, you have the deposit which can start from 10% of the cars value, and then you pay off the value of the car with interest, within monthly installment over a fixed term.

Once the HP term has come to an end you will be given two options:

- Pay a transfer fee

- Option fee

You get to decide on which option you want to take at the end of the term, in order to take ownership of the car. You will not own the car until you have made said payment, meaning you will not be able to sell without having permission from the lender.

So what are the pros of HP? You can pick which HP term is best suited to your budget, the longer the term you decide to take, the cheaper your monthly payments will be, but that will increase the interest you will pay overall. Once you have made all of your monthly payments and decided which final payment you would like to make, the car will be yours. If you don’t have a good credit history it may be easier for you to get approved for HP. There are no limits on the mileage you can do per year, resulting in no extra charges.

The cons of HP? The car is owned by the finance company until you have made the final payment. Servicing packages aren’t included. You are not allowed to sell or modify the car throughout the HP term without having permission from your finance company. HP can be more expensive. If you do not keep up with monthly payments, your car will be repossessed via the finance company.

Personal Contract Hire (PCH)

PCH is considered to be similar to renting a car. You pay the deposit, decide on an amount for the monthly payments and the car is yours for the duration of the agreement term. Any damages that occur during the lease will result in you having to pay for repairs. The deposit you place is equivalent to three-six times the monthly payment. The longer the agreement, the lower the monthly payment.

The difference between PCH and PCP is that you do not have the option to buy the car at the end of the agreement. You will need to hand it back. PCH is typically more aimed towards businesses, resulting in the prices excluding VAT. You will need to question whether it includes VAT or not.

So what are the pros of PCH? You don’t need to worry about the cars depreciation. Delivery, breakdown, road tax and warranty are included in most PCH deals. Monthly payments tend to be cheaper on PCH than PCP. You have the choice to change car reasonably often.

The cons of PCH? The deposit required tends to be higher than PCP. You do not get to buy the car at the end of the agreed term. PCH deals have mileage limits, if you exceed you will receive financial penalties. You have to pay for any damage occurred that is beyond wear and tear. Financial costs may be needed if you take the car abroad.

Personal Loan

Personal loans consist of you borrowing a fixed sum. Then repay it in fixed monthly payments, plus interest. Loan terms can vary. The interest rates may also vary depending on the amount of money you borrow. The lower the loan, the higher the APR. The higher the loan, the lower the APR.

You can get secured or unsecured loans when it comes to personal loans. A secured loan is usually considered to be cheaper, but puts your properties at risk if you fail to keep up with your payments. Unsecured loans are most costly but less risky.

So what are the pros of Personal Loan? There are a wide variety of loan providers. From banks and building societies etc. You can use a personal loan to buy from private sellers. Being a cash buyer can usually give you a better advantage to get a better price for the car. You have the option to pay part cash and part loan. You own the car from receiving it, and have the option to modify in whatever way you like, unlimited mileage use and can even sell it.

The cons of Personal Loan? Monthly payments may be higher than other forms of car finance. You will be responsible for all repairs and servicing due to you owning the car outright. The value of the car will depreciate, meaning it will be worth a lot less than what you paid for it if you decide to sell. If you do decide to sell before the loan has been paid off, you will still need to pay the loan off.

If you have a bad credit score, you will still be able to get a car on finance. There is no minimum credit score. However, having a poor rating will make you a higher risk to lenders, therefore resulting in you to be less likely to get accepted by a lender. It is also possible for the interest rates to increase.

Cash Offers Example:

PCP 0% Example:

Congratulations for 20 Years Service

Congratulations to Phil Melina and Sheila Wassell on reaching an impressive...

How to Keep Cool in a Car Without Using Air-Con

As Britain is basking in the heatwave, knowing how...

We are now an approved Renault Pro+ Commercial dealership!

Right Car Renault are happy to announce that we are...

The New Renault plug-in Hybrid

As you may or may not know, Renault have introduced...

Benefits of Owning an EV

Benefits of owning an EV Many people are aware of...

Car Dashboard Lights and what they mean

We’ve all had that moment when driving along peacefully and...

The Ford Fiesta - The UK's Best-Selling Car 9 Years Running

Ford Fiesta – The best-selling car 9 years running ...

Christmas Gift Ideas for Car Lovers

Christmas Gift Ideas for Car Lovers We all know...

Tips and Tricks to improve your MPG

Tips and Tricks to improve your MPG Here are...

Classic Cars from around the world

Classic Cars from around the world! The world has seen...

Top Causes of Car Accidents in the UK

Top causes of car accidents in the UK Here...

Tips for Safe Winter Motoring

Tips for Safe Winter Motoring The nights are getting...

The Changes to the Plug-In Grant and how it may affect your future purchase

The changes to the Plug-In Car Grant The changes...

Cancer Research UK Donation

Cancer Research UK: Renault 120 Year Weekend A few...

Dacia Sandero: Multi Award Winner

Dacia Sandero: Award Winning for a reason. The Dacia...

Buying a Used Car: Top Ten Tips

Buying a Used Car: Top Ten Tips When buying...

Brand new website! Designed with you in mind.

The antiquated Right Car website has recently undergone a complete...

The RightCar Latest Offers are currently being updated. Check back soon.